A History of Banking Where You’re Known

with a Future of Moving you Forward

Personal Banking Services

Gold Premier Money Market

![]() Maximize your savings with a Personal Premier Money Market Account!

Maximize your savings with a Personal Premier Money Market Account!

- Minimum opening balance $5,000.

- Minimum balance to obtain Annual Percentage Yield (APY) is based on the following tier levels: $0.00 to $4,999.99; $5,000 to $24,999.99; $25,000 to $99,999.99; $100,000 to $174,999.99; $175,000 and up.

- Interest is computed on daily balance.

- Interest is compounded daily and credited monthly.

- Interest begins to accrue on the business day you deposit cash or non-cash items (example: checks).

- Up to six withdrawals per month.

- Accounts closed before the end of the statement cycle forfeit accrued interest.

- Monthly maintenance service charge of $10 if the daily balance drops below $5,000 any day of the month.

*Interest Rate and Annual Percentage Yield (APY) is variable for each balance tier (rate sheets are available upon request), and subject to change at any time.

Personal Money Market Account

![]() Maximize your savings with a State Bank Group Money Market Account!

Maximize your savings with a State Bank Group Money Market Account!

- Minimum balance $1000.

- Minimum opening balance $1000.

- Interest begins to accrue on the business day you deposit cash or non-cash items (example checks).

- Interest is computed on daily balance.

- Interest is compounded daily and credited monthly.

- Up to six withdrawals per month.

- Accounts closed before the end of the statement cycle forfeit accrued interest.

- Account Charges: Monthly maintenance service charge of $6 if the daily balance drops below $1000 any day of the month.

*Interest Rate and Annual Percentage Yield (APY) are variable, and subject to change at any time.

IRA Accounts

![]() The State Bank Group’s IRAs are a smart way to save for your future. Most IRA accounts are tax deductible and have a maximum yearly contribution that is set by the IRS. If you already have an IRA, you should have it reviewed on a regular basis to make sure you are receiving maximum benefit from it. Now is the time to take advantage of an IRA account that may provide you with tax deferred savings. We offer:

The State Bank Group’s IRAs are a smart way to save for your future. Most IRA accounts are tax deductible and have a maximum yearly contribution that is set by the IRS. If you already have an IRA, you should have it reviewed on a regular basis to make sure you are receiving maximum benefit from it. Now is the time to take advantage of an IRA account that may provide you with tax deferred savings. We offer:

- Traditional IRAs

- Roth IRAs

- IRA Certificates of Deposit

- SEP IRAs

*Please contact one of our offices for current rates. IRS regulations regarding IRAs are constantly being updated. Changes such as new contribution limits and new types of accounts are common, so check with one of our new accounts associates to get all the details.

Health Savings Accounts

![]() The State Bank Group Offer Health Savings Accounts!

The State Bank Group Offer Health Savings Accounts!

- Do you have a Qualifying High Deductible Health Plan?

- Are you concerned about the ever-increasing costs of health care?

- Would you like an easy and secure way to set aside dollars for health care expenses?

Open a Health Savings Account Today and Start Offsetting Qualified Medical Expenses. To qualify for a Health Savings Account, you must be participating in a qualified High Deductible Health Plan (HDHP), and your annualized deposit must remain within government limits. Other limitations may apply. Check with your insurance agent or tax adviser to confirm eligibility. Compare a Health Savings Account to an IRA. Contributions reduce taxable income however, only the interest on the account is tax deferred. Funds can be withdrawn tax free for eligible medical expenses. Click here for more detailed information.

Certificate of Deposit

![]() A special type of savings account that may offer a higher interest rate than a standard savings account.

A special type of savings account that may offer a higher interest rate than a standard savings account.

- Minimum balance $1000, minimum balance to obtain (annual percentage yield) APY is $1,000.

- Interest Rate and the APY will not change for the term of the deposit.

- Interest Computation Method is daily balance. Interest Compounding is daily. Interest credit frequency: Term 90 days or less at maturity - Term: 91 days or more, monthly, quarterly, semi-annually or annually

- Interest begins to accrue on the business day you deposit non-cash items (example: checks).

- The APY assumes interest remains in the account until maturity.

- If any principal is withdrawn prior to maturity, a substantial penalty may apply.

- A notice will be mailed prior to maturity.

- Funds may be withdrawn up to 10 calendar days after the maturity date without penalty.

Excluding CD specials, certificates of deposit will renew automatically for the same term at the current APY in effect at the time of maturity. Additional deposits may only be made at renewal up to 10 calendar days after the maturity date.

Statement Savings

![]() Build up your cash reserves with a State Bank Group savings account to get closer to important financial goals.

Build up your cash reserves with a State Bank Group savings account to get closer to important financial goals.

- Minimum balance $100.

- Minimum opening balance $100.

- Minimum balance to obtain APY $100.

- Up to six withdrawals per month.

- Interest is computed on daily balance. Interest is compounded daily and credited monthly.

- Interest begins to accrue on the business day you deposit cash or non-cash items (example: checks).

- Accounts closed before the end of the statement cycle forfeit accrued interest.

- Account Charges: Monthly maintenance service charge if the balance drops below $100 any day of the month is $3.

*Interest Rate and Annual Percentage Yield (APY) are variable and subject to change at any time.

External Transfers: The Easy Way to Move Money

Bank-to-bank external transfers make it easy for you to send money to and from your checking and savings accounts, no matter where your cash is.

![]() Move your money from your accounts at other banks into your primary bank account in just a few clicks. It's easy, saves time, and eliminates the need for checks. With External Transfers, your money is always in easy reach – so you can be ready for whatever life has in store. Just log in to your online banking account to get started.

Move your money from your accounts at other banks into your primary bank account in just a few clicks. It's easy, saves time, and eliminates the need for checks. With External Transfers, your money is always in easy reach – so you can be ready for whatever life has in store. Just log in to your online banking account to get started.

- Transfer funds between The State Bank Group (TSBG) accounts and accounts at other U.S. financial institutions (fee may apply)1

- No charge for funds transferred into your TSBG account

- Accessible via online and mobile banking (under the "TRANSFER" tab)

- Make one-time, recurring transfers

- Schedule transfers for the future

- Review scheduled and completed transfers

Get Started with External Transfers through Online Banking

First sign in to Online Banking and then click the "Transfer Funds" Tab.

On the left side of the page, click on "Transfer to an Account Outside this Financial Institution."

Choose from the list of established accounts, or add a new external account.

or

Access Mobile Banking to access External Transfers

From your Mobile App, click on "Transfer & Pay", and then, "Make an External Transfer."

Choose from the list of established accounts, or add a new external account.

1 A transaction fee of $2 may apply when transferring funds from your TSBG account to an account at another financial institution using External Transfers service. Individual daily and monthly transfer limits will apply.

Business Credit Card

![]() Choose the card that is right for your business - Standard Card with no annual fee or the Preferred Points Rewards Card.

Choose the card that is right for your business - Standard Card with no annual fee or the Preferred Points Rewards Card.

Business Card – Standard Card

Features

- No annual fee.

- Competitive ongoing APR.1

- 25-day interest-free grace period on all purchases. No grace period on cash advances.

- Individual and summary billing options.

Benefits

- 24-hour toll-free live customer assistance available at 800-367-7576.

- Online account information available 24/7 at www.cardaccount.net.

- Rental car collision damage waiver protection and a host of extraordinary MasterCard benefits.

Fees

- Other fees may be charged, these fees are listed on the downloadable application.

Business Card – Preferred Points Rewards

Features

- Earn one reward point for each dollar spent, up to 10,000 points per month.

- Low annual fee of $49.00 per account.

- Competitive ongoing APR. 1

- 25-day interest-free grace period on all purchases. No grace period on cash advances.

- Individual billing option only.

Benefits

- Redeem your rewards points for cash-back awards, retail gift cards, travel and a wide variety of merchandise including cameras, mp3 players, home theater systems, portable DVD players, sporting equipment, jewelry, luggage, electronics, video game equipment, gift cards and more.

- To view or redeem rewards points, visit www.mypreferredpoints.com or call 866-678-5191.

- 24-hour toll-free live customer assistance available at 800-367-7576.

- Online account information available 24/7 at www.cardaccount.net.

- Rental car collision damage waiver protection and a host of extraordinary MasterCard benefits.

Extraordinary MasterCard® BusinessCard benefits include

- Car Rental Collision Damage Waiver

- Extended Warranty

- Purchase Protection

- Travel Accident Insurance

- Travel Assistance

- Roadside Assistance

- Baggage Delay Insurance

Certain restrictions apply detailed in the applicable benefits brochure received with new credit card.

Fees

- Other fees may be charged, these fees are listed on the downloadable application.

To Apply Now

Download the PDF of the application.

- Type the information and then print the application (you cannot save the document, so print an extra copy for yourself), or print it and then complete it using a blue or black pen.

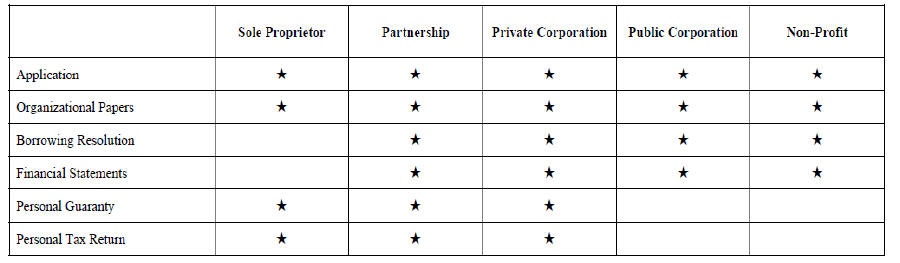

- Supporting documents vary depending on the type of business you have. See chart below.

- Fax your completed application to the Card Service Center at 877-809-9162.

- Or mail your completed application to: Card Service Center PO Box 569120 Dallas, TX 75356-9120

1Please see application for information about current APRs and fees.

Supporting Documents for Your Card Application

Pages

© 2024 Contact | Privacy Notice | IL CRA Notice | Terms of Use